Idaho Property Taxes In 2023

Understanding property taxes is essential for homeowners. It's that time of the year again when we anticipate the impact of property taxes in 2023 in Idaho. Tax notices will be sent out in late November, and there’s reason for optimism that homeowners will see significant savings on their property taxes.

Property taxes are the lifeblood of crucial local services. They fund the police department, road maintenance, fire services, public safety, libraries, and parks. Understanding the allocation of your tax dollars is vital to appreciate the impact of property taxes on your community.

The good news for Idaho homeowners is that property tax savings are on the horizon in 2023. Tax rebates will be issued to qualifying homeowners, thanks to a budget surplus of $99 million from the 2023 fiscal year. This surplus is a welcome relief for homeowners. In order to qualify, you must be an Idaho resident and have the homeowners exemption for your property.

Determining Your Property Tax

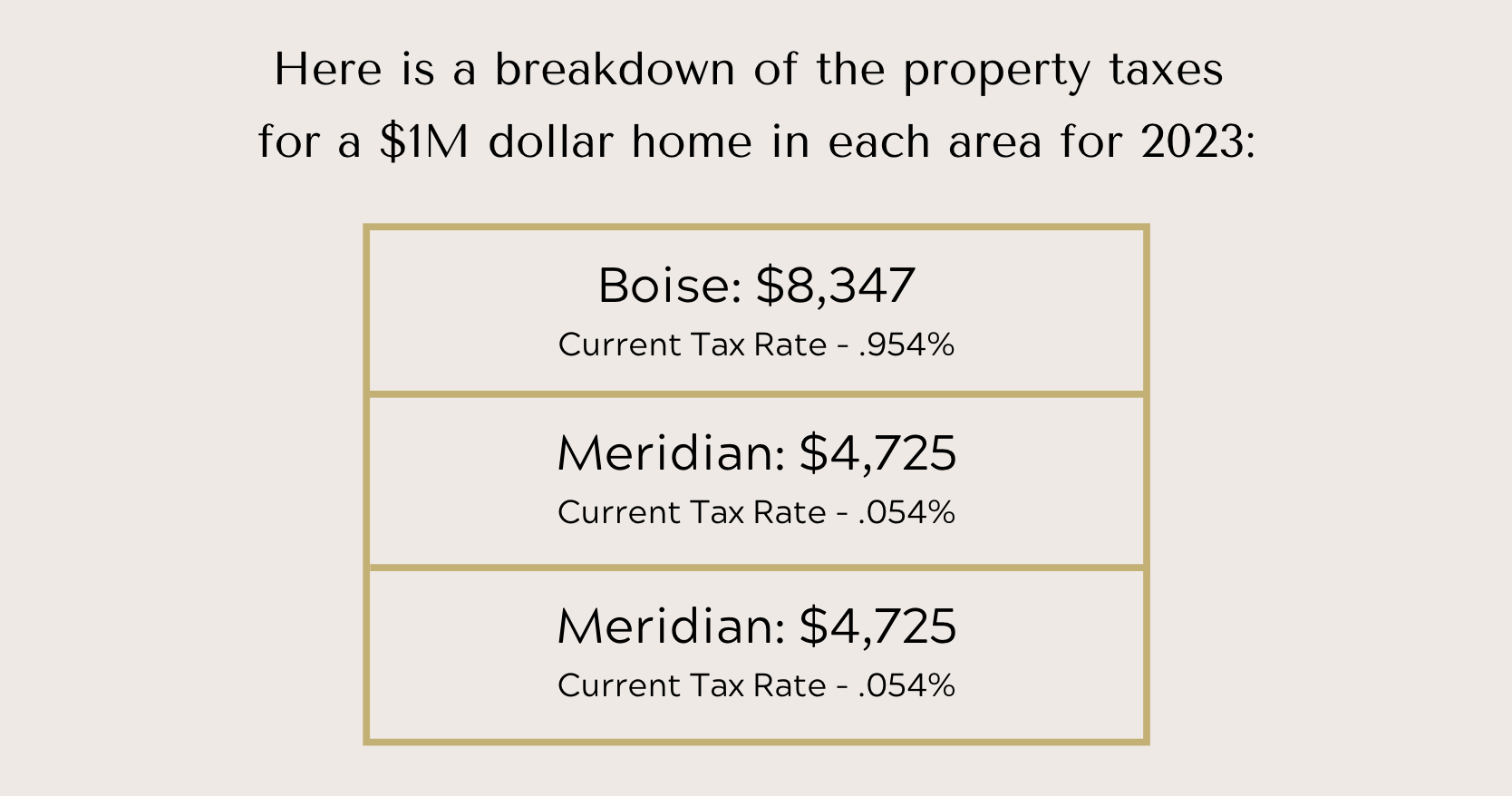

To better grasp the distribution of property taxes rates, property tax rates in selected areas of Idaho include:

You’ll notice Eagle residents have a property tax rate half of the Boise residents.

Two significant factors affecting property taxes are the assessed value of your property and potential homestead exemptions. These factors can significantly influence your property tax bill, making it essential to stay informed about them.

In order to determine how much you will pay in taxes based on these rates, you first tax the assessed value of the home, subtract the $125,000 homestead exemption and then apply the tax rate for your area.

For example a Boise home assessed at $1,000,000 would be taxed at $875,000 after the homestead exemption, the property tax would be $8,347.50. 3. You Aren’t Flexible

Flexibility is essential when selling a home. Some sellers are rigid about showing times, negotiations, or closing dates, which can alienate potential buyers. Be willing to accommodate the schedules and requests of serious buyers. If you can, offer flexibility in your pricing strategy, be open to negotiations, and strive for a win-win situation for both you and the buyer. A flexible approach can help you sell your home faster and with less stress.

Eagle and Meridian residents pay a much lower property tax than those living in Boise.

Tax Rebates Save the Day

In addition to local initiatives, Idaho is taking a broader approach to property tax relief. All property tax payers in the state will receive property tax relief in 2023 and beyond, funded by state resources. Furthermore, more people will qualify for Idaho's Property Tax Reduction program, also known as the Circuit Breaker Program, due to relaxed legislative requirements.

In its first year, the law could provide up to $355 million in property tax relief. Over the next two years, it could offer approximately $110 million to reduce property taxes for homeowners, around $100 million to reduce property taxes for all property tax payers, and about $100 million distributed to school districts based on average daily attendance.

It's important to note that the impact on individual property taxes will vary based on factors like school levies, budget decisions made by taxing districts in the coming months, and changes in property values. Specific reductions will be determined in the fall and reflected on tax bills sent out in late November.

Idaho homeowners can expect property tax savings in 2023, both at the local and statewide levels. Understanding the complexities of property taxes, including levies, assessed values, and fund allocation, is essential for making informed financial decisions. As you receive your property tax notices in November, be sure to review them carefully and take advantage of any available tax relief programs. Idaho's commitment to property tax relief aims to ease the financial burden on residents and contribute to the well-being of the community.

If you have any questions about your property taxes, reach out to the McFerrin Real Estate and we can help.